Expo

view channel

view channel

view channel

view channel

view channel

view channel

view channel

view channel

view channel

Clinical Chem.Molecular DiagnosticsHematologyImmunologyMicrobiologyPathologyTechnologyIndustry

Events

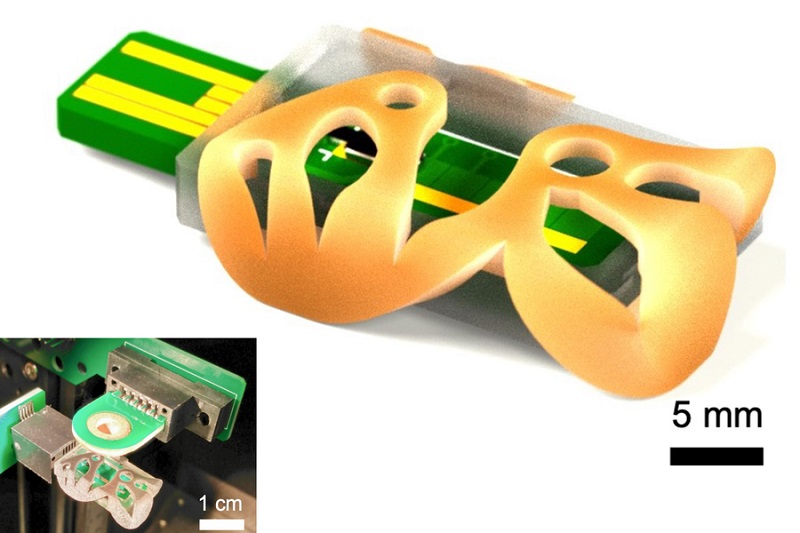

- POC Biomedical Test Spins Water Droplet Using Sound Waves for Cancer Detection

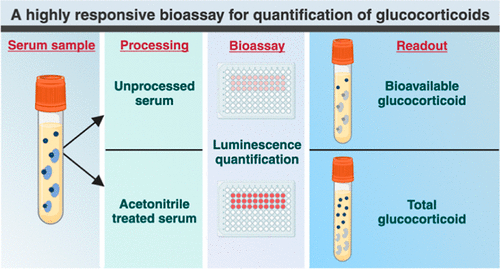

- Highly Reliable Cell-Based Assay Enables Accurate Diagnosis of Endocrine Diseases

- New Blood Testing Method Detects Potent Opioids in Under Three Minutes

- Wireless Hepatitis B Test Kit Completes Screening and Data Collection in One Step

- Pain-Free, Low-Cost, Sensitive, Radiation-Free Device Detects Breast Cancer in Urine

- Low-Cost Point-Of-Care Diagnostic to Expand Access to STI Testing

- 18-Gene Urine Test for Prostate Cancer to Help Avoid Unnecessary Biopsies

- Urine-Based Test Detects Head and Neck Cancer

- Blood-Based Test Detects and Monitors Aggressive Small Cell Lung Cancer

- Blood-Based Machine Learning Assay Noninvasively Detects Ovarian Cancer

- First 4-in-1 Nucleic Acid Test for Arbovirus Screening to Reduce Risk of Transfusion-Transmitted Infections

- POC Finger-Prick Blood Test Determines Risk of Neutropenic Sepsis in Patients Undergoing Chemotherapy

- First Affordable and Rapid Test for Beta Thalassemia Demonstrates 99% Diagnostic Accuracy

- Handheld White Blood Cell Tracker to Enable Rapid Testing For Infections

- Smart Palm-size Optofluidic Hematology Analyzer Enables POCT of Patients’ Blood Cells

- AI Tool Precisely Matches Cancer Drugs to Patients Using Information from Each Tumor Cell

- Genetic Testing Combined With Personalized Drug Screening On Tumor Samples to Revolutionize Cancer Treatment

- Testing Method Could Help More Patients Receive Right Cancer Treatment

- Groundbreaking Test Monitors Radiation Therapy Toxicity in Cancer Patients

- State-Of-The Art Techniques to Investigate Immune Response in Deadly Strep A Infections

- Unique Metabolic Signature Could Enable Sepsis Diagnosis within One Hour of Blood Collection

- Simple Blood Test Combined With Personalized Risk Model Improves Sepsis Diagnosis

- Groundbreaking Diagnostic Platform Provides AST Results With Unprecedented Speed

- Blood Analysis Predicts Sepsis and Organ Failure in Children

- TB Blood Test Could Detect Millions of Silent Spreaders

- DNA Biosensor Enables Early Diagnosis of Cervical Cancer

- Self-Heating Microfluidic Devices Can Detect Diseases in Tiny Blood or Fluid Samples

- Breakthrough in Diagnostic Technology Could Make On-The-Spot Testing Widely Accessible

- First of Its Kind Technology Detects Glucose in Human Saliva

- Electrochemical Device Identifies People at Higher Risk for Osteoporosis Using Single Blood Drop

- Bosch and Randox Partner to Make Strategic Investment in Vivalytic Analysis Platform

- Siemens to Close Fast Track Diagnostics Business

- Beckman Coulter and Fujirebio Expand Partnership on Neurodegenerative Disease Diagnostics

- Sysmex and Hitachi Collaborate on Development of New Genetic Testing Systems

- Sysmex and CellaVision Expand Collaboration to Advance Hematology Solutions

- Gene Panel Predicts Disease Progession for Patients with B-cell Lymphoma

- New Method Simplifies Preparation of Tumor Genomic DNA Libraries

- New Tool Developed for Diagnosis of Chronic HBV Infection

- Panel of Genetic Loci Accurately Predicts Risk of Developing Gout

- Disrupted TGFB Signaling Linked to Increased Cancer-Related Bacteria

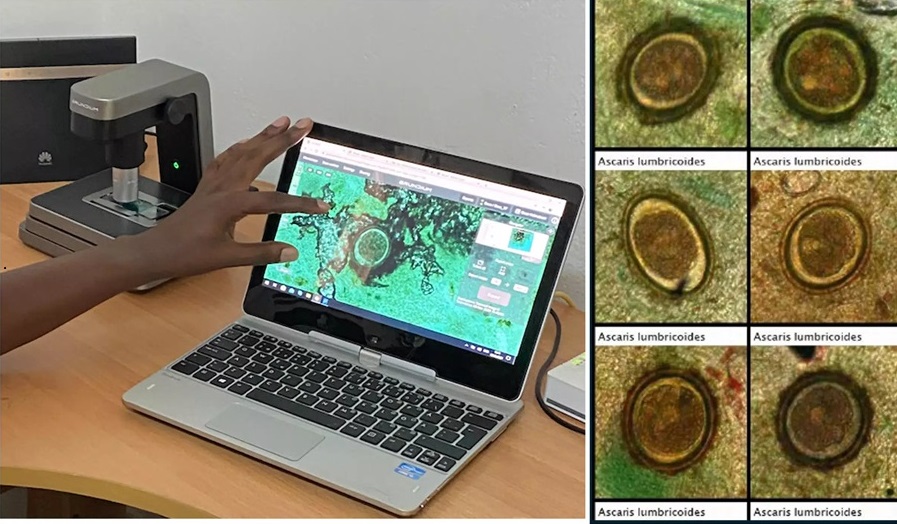

- Image-Based AI Shows Promise for Parasite Detection in Digitized Stool Samples

- Deep Learning Powered AI Algorithms Improve Skin Cancer Diagnostic Accuracy

- Microfluidic Device for Cancer Detection Precisely Separates Tumor Entities

- Virtual Skin Biopsy Determines Presence of Cancerous Cells

- AI Detects Viable Tumor Cells for Accurate Bone Cancer Prognoses Post Chemotherapy

Expo

view channel

view channel

view channel

view channel

view channel

view channel

view channel

view channel

view channel

Clinical Chem.Molecular DiagnosticsHematologyImmunologyMicrobiologyPathologyTechnologyIndustry

Events

Advertise with Us

view channel

view channel

view channel

view channel

view channel

view channel

view channel

view channel

view channel

Clinical Chem.Molecular DiagnosticsHematologyImmunologyMicrobiologyPathologyTechnologyIndustry

Events

Advertise with Us

- POC Biomedical Test Spins Water Droplet Using Sound Waves for Cancer Detection

- Highly Reliable Cell-Based Assay Enables Accurate Diagnosis of Endocrine Diseases

- New Blood Testing Method Detects Potent Opioids in Under Three Minutes

- Wireless Hepatitis B Test Kit Completes Screening and Data Collection in One Step

- Pain-Free, Low-Cost, Sensitive, Radiation-Free Device Detects Breast Cancer in Urine

- Low-Cost Point-Of-Care Diagnostic to Expand Access to STI Testing

- 18-Gene Urine Test for Prostate Cancer to Help Avoid Unnecessary Biopsies

- Urine-Based Test Detects Head and Neck Cancer

- Blood-Based Test Detects and Monitors Aggressive Small Cell Lung Cancer

- Blood-Based Machine Learning Assay Noninvasively Detects Ovarian Cancer

- First 4-in-1 Nucleic Acid Test for Arbovirus Screening to Reduce Risk of Transfusion-Transmitted Infections

- POC Finger-Prick Blood Test Determines Risk of Neutropenic Sepsis in Patients Undergoing Chemotherapy

- First Affordable and Rapid Test for Beta Thalassemia Demonstrates 99% Diagnostic Accuracy

- Handheld White Blood Cell Tracker to Enable Rapid Testing For Infections

- Smart Palm-size Optofluidic Hematology Analyzer Enables POCT of Patients’ Blood Cells

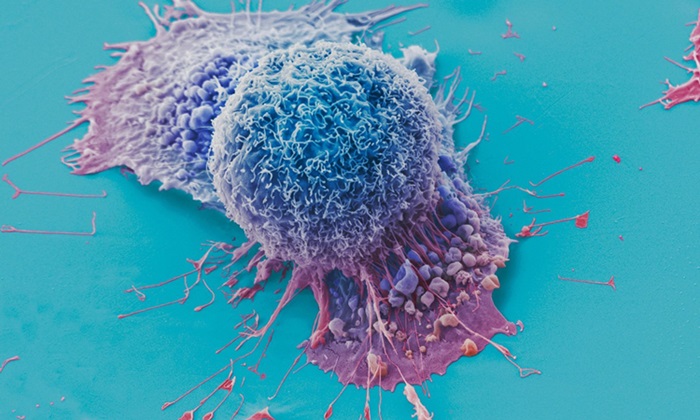

- AI Tool Precisely Matches Cancer Drugs to Patients Using Information from Each Tumor Cell

- Genetic Testing Combined With Personalized Drug Screening On Tumor Samples to Revolutionize Cancer Treatment

- Testing Method Could Help More Patients Receive Right Cancer Treatment

- Groundbreaking Test Monitors Radiation Therapy Toxicity in Cancer Patients

- State-Of-The Art Techniques to Investigate Immune Response in Deadly Strep A Infections

- Unique Metabolic Signature Could Enable Sepsis Diagnosis within One Hour of Blood Collection

- Simple Blood Test Combined With Personalized Risk Model Improves Sepsis Diagnosis

- Groundbreaking Diagnostic Platform Provides AST Results With Unprecedented Speed

- Blood Analysis Predicts Sepsis and Organ Failure in Children

- TB Blood Test Could Detect Millions of Silent Spreaders

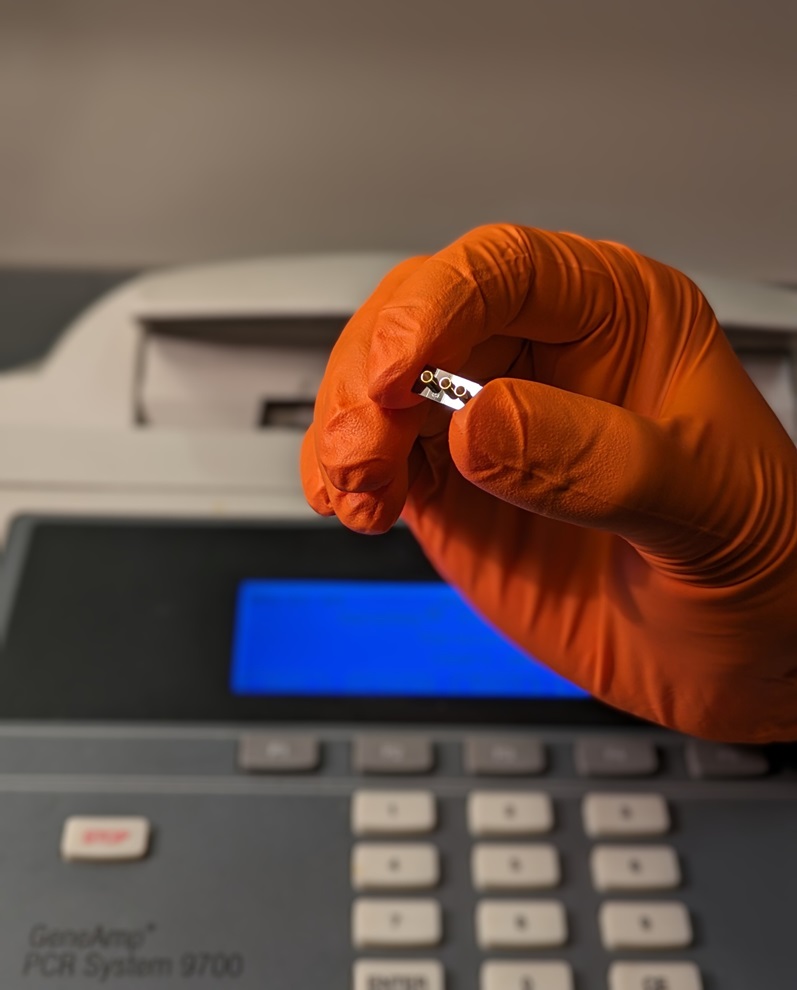

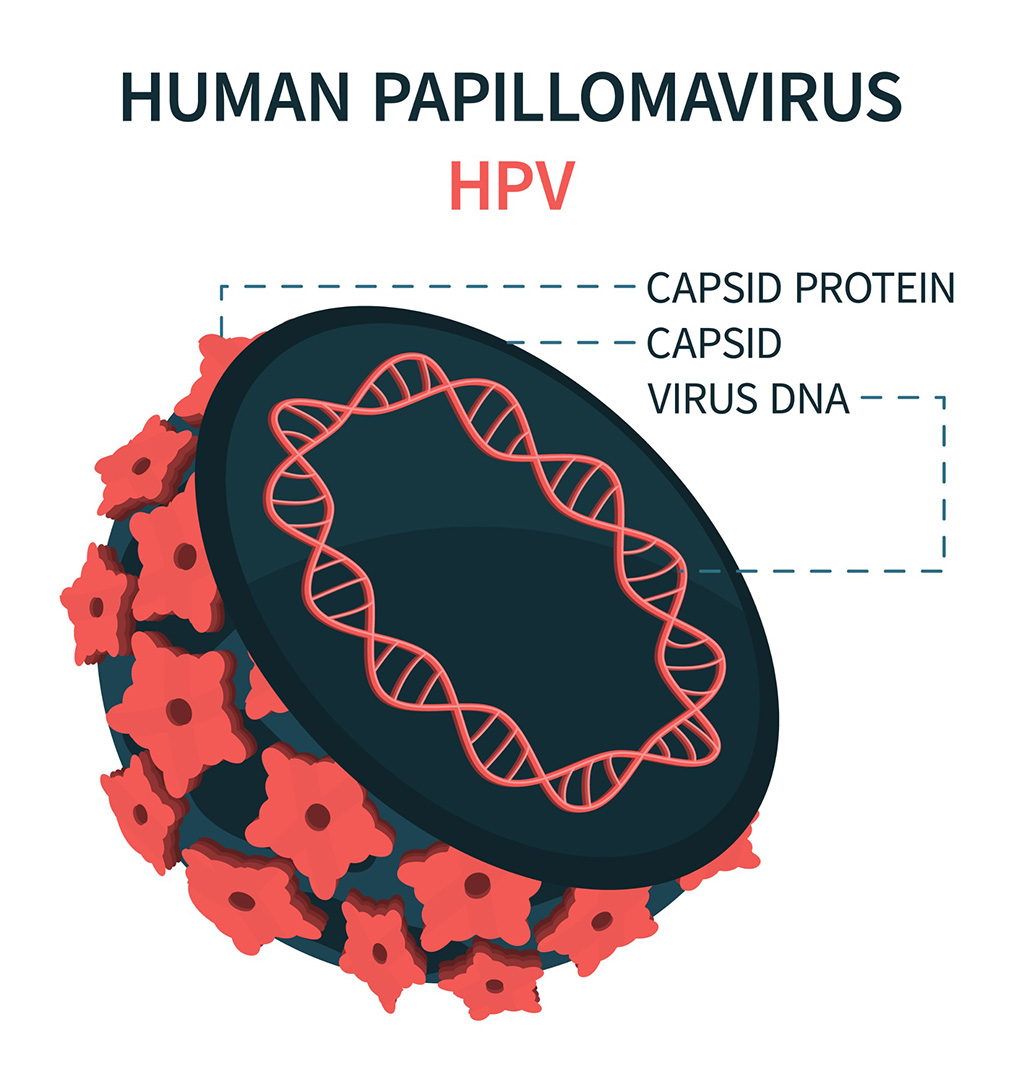

- DNA Biosensor Enables Early Diagnosis of Cervical Cancer

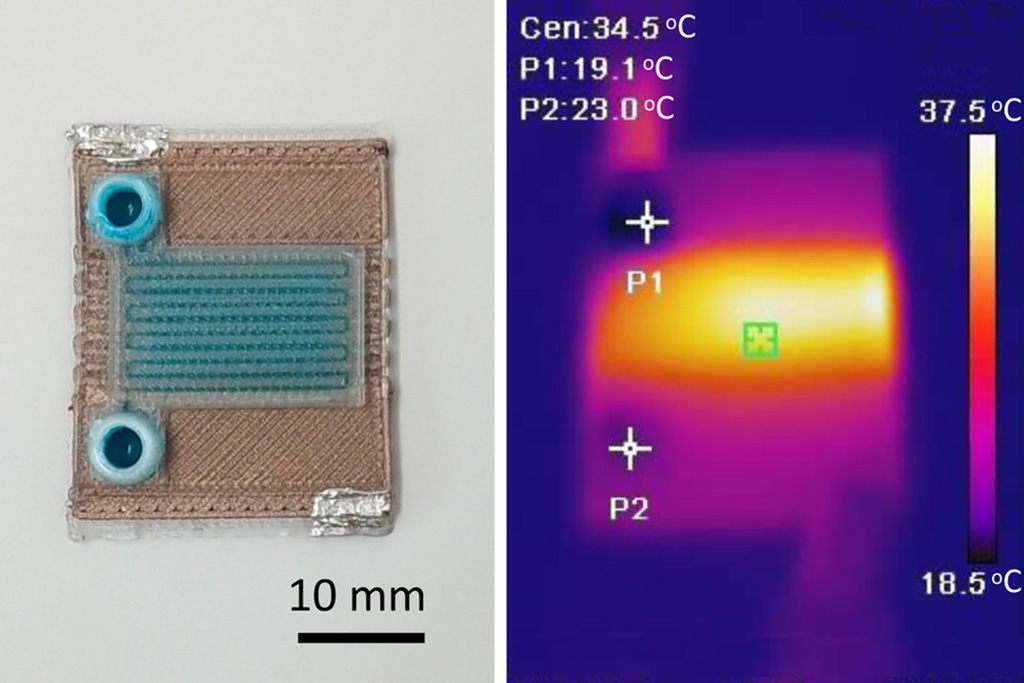

- Self-Heating Microfluidic Devices Can Detect Diseases in Tiny Blood or Fluid Samples

- Breakthrough in Diagnostic Technology Could Make On-The-Spot Testing Widely Accessible

- First of Its Kind Technology Detects Glucose in Human Saliva

- Electrochemical Device Identifies People at Higher Risk for Osteoporosis Using Single Blood Drop

- Bosch and Randox Partner to Make Strategic Investment in Vivalytic Analysis Platform

- Siemens to Close Fast Track Diagnostics Business

- Beckman Coulter and Fujirebio Expand Partnership on Neurodegenerative Disease Diagnostics

- Sysmex and Hitachi Collaborate on Development of New Genetic Testing Systems

- Sysmex and CellaVision Expand Collaboration to Advance Hematology Solutions

- Gene Panel Predicts Disease Progession for Patients with B-cell Lymphoma

- New Method Simplifies Preparation of Tumor Genomic DNA Libraries

- New Tool Developed for Diagnosis of Chronic HBV Infection

- Panel of Genetic Loci Accurately Predicts Risk of Developing Gout

- Disrupted TGFB Signaling Linked to Increased Cancer-Related Bacteria

- Image-Based AI Shows Promise for Parasite Detection in Digitized Stool Samples

- Deep Learning Powered AI Algorithms Improve Skin Cancer Diagnostic Accuracy

- Microfluidic Device for Cancer Detection Precisely Separates Tumor Entities

- Virtual Skin Biopsy Determines Presence of Cancerous Cells

- AI Detects Viable Tumor Cells for Accurate Bone Cancer Prognoses Post Chemotherapy

.jpg)

.jpg)

.jpg)